Borrow against your investments using Barita Online. Customers are able to:

- Apply by selecting the type of loan, amount and repayment period.

- Select your specific investment to use as collateral.

- Tell us where to send loan proceeds.

- See the detailed breakdown of loan charges.

- Access existing loan details online.

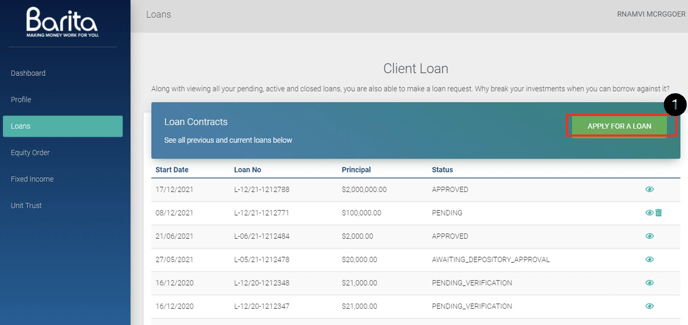

- Select Loans from the Navigation Bar.

- Select “APPLY FOR A LOAN” from the top menu.

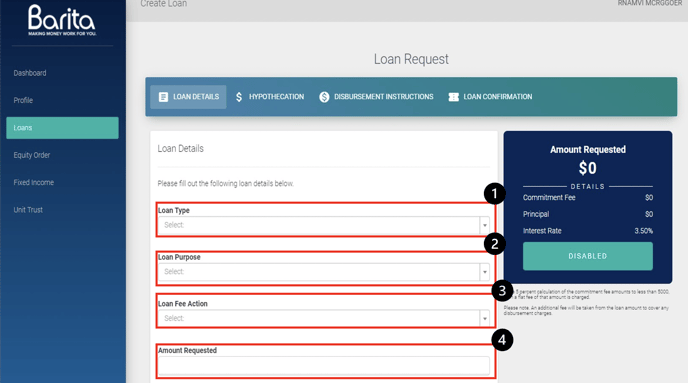

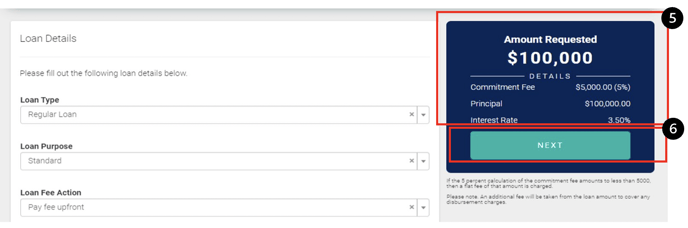

- Select the ‘Loan Type’ you’d like to request:

- Regular Loan

- Interest Only Loan

- Select your ‘Loan Purpose’:

- Standard

- Margin

- Select ‘Loan Fee Action’:

- Pay fee upfront

- Add fee to the loan amount (Add Fee)

- Take fee from the loan amount (Deduct Fee)

- Then enter the amount you’d like to request.

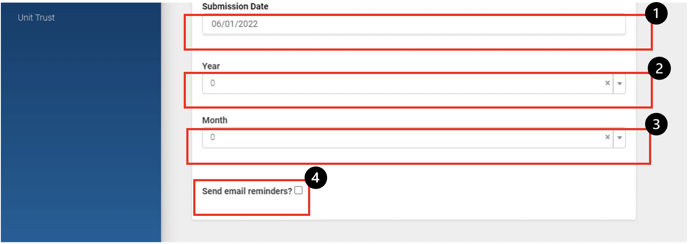

- Select Submission Date.

- Select the number of ‘Years’.

- Select the number of ‘Months’.

- Then confirm if you would like to receive email reminders.

- Review your ‘Amount Requested’ including

- Commitment fee

- Principal

- Interest Rate

- Select ‘NEXT’ to continue

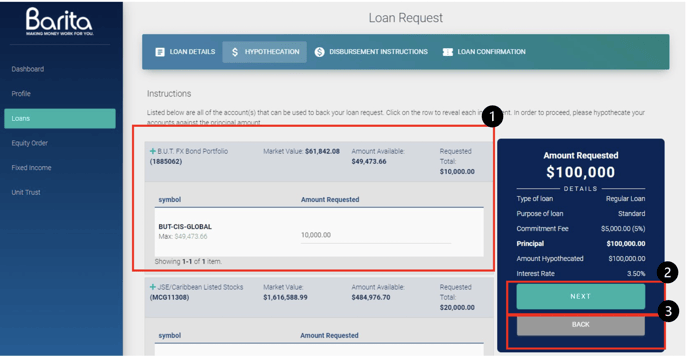

- You may now enter your hypothecation instructions revealing your available accounts to borrow against.

- Select ‘NEXT’ to confirm.

- Select ‘BACK’ to load the previous page and undo the information added.

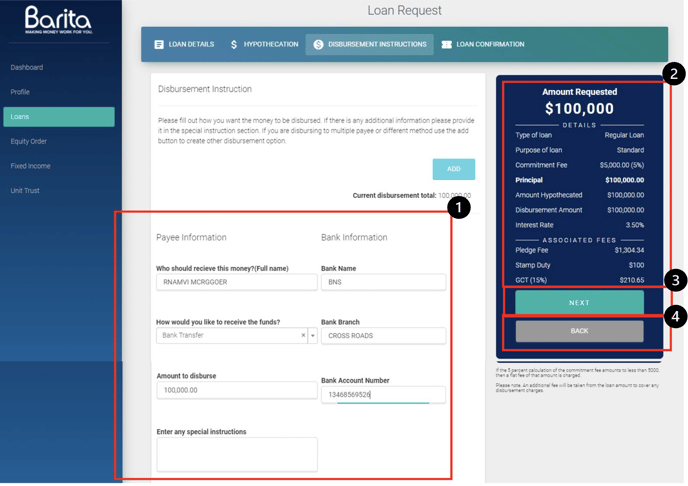

- Now enter your banking information.

- Amount Requested will display your Loan details and associated fees.

- Select ‘NEXT’ to confirm.

- Select ‘BACK’ to load the previous page and undo the information added.

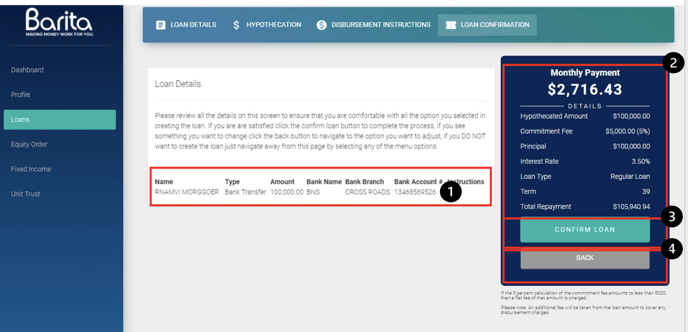

- Review Loan application and Monthly Payment details.

- Select ‘CONFIRM LOAN’ to continue.

- Select ‘BACK’ to load the previous page and undo the information added.

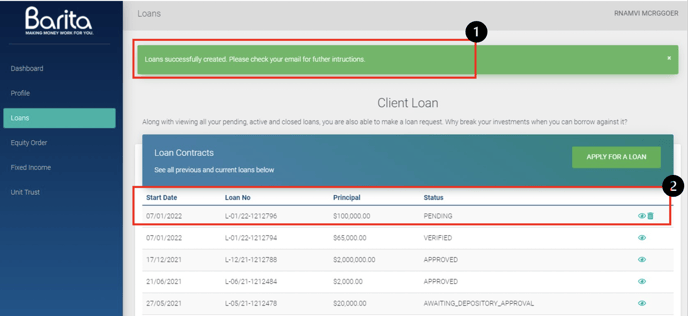

- A ‘Loan Successful’ message will indicate the transaction has been submitted to the next stage in the process.

- You Loan request will be added to account history in pending state. Below are options to the pending state:

- View

- Delete